“Shouldn’t be asking, wild and scheming.

Could be my Election Day.”

How did we get here? In the last 80 years we had been more concerned with winning the Cold War by forming trade alliances and the US Navy protecting the world’s oceans for international trade. Only thing is the Cold War ended in 1991 (https://en.wikipedia.org/wiki/Cold_War) and the world continued to operate as a global network with the United States as the largest consumer market.

Trade for inexpensive goods, the creation of complex supply chains and just-in-time manufacturing brought advancement in technology at very competitive prices. Emerging markets and manufacturing in China and Mexico grew due to inexpensive labor. Previous manufacturing hubs in the US like Detroit, Toledo, Buffalo and Pittsburgh, once manufacturing and steel production powerhouses became what we call the “Rust Belt” https://www.investopedia.com/terms/r/rust-belt.asp

The United States funded wars in the Middle East to protect oil producing countries.

Going almost unnoticed, the United States became an oil producing country through the development of fracking technologies. Providing security for oil trade worldwide began to make less sense.

In the meantime, the European Union formed its own Euro currency and trade cooperative seeking to rival the US dollar. Trade deficits and debts grew for the United States.

Something had to change to put the United States on a firm financial position going forward.

A new regime was promised by President Trump remaking and modernizing the current national government trade policies. He called it “Liberation Day”.

https://www.csis.org/analysis/liberation-day-tariffs-explained

From April 2nd 2025 up until now, the first nine months of the second Trump Administration has placed targeted tariffs on imported goods as to previously there were almost no restrictions to trade coming into the United States. However there had been many tariffs placed on US exports.

So far the results have been mixed but seem to be working positively to bring in more income and encourage companies to invest and hire in the United States, moving manufacturing and assembly of goods locally.

Now about that debt and deficit:

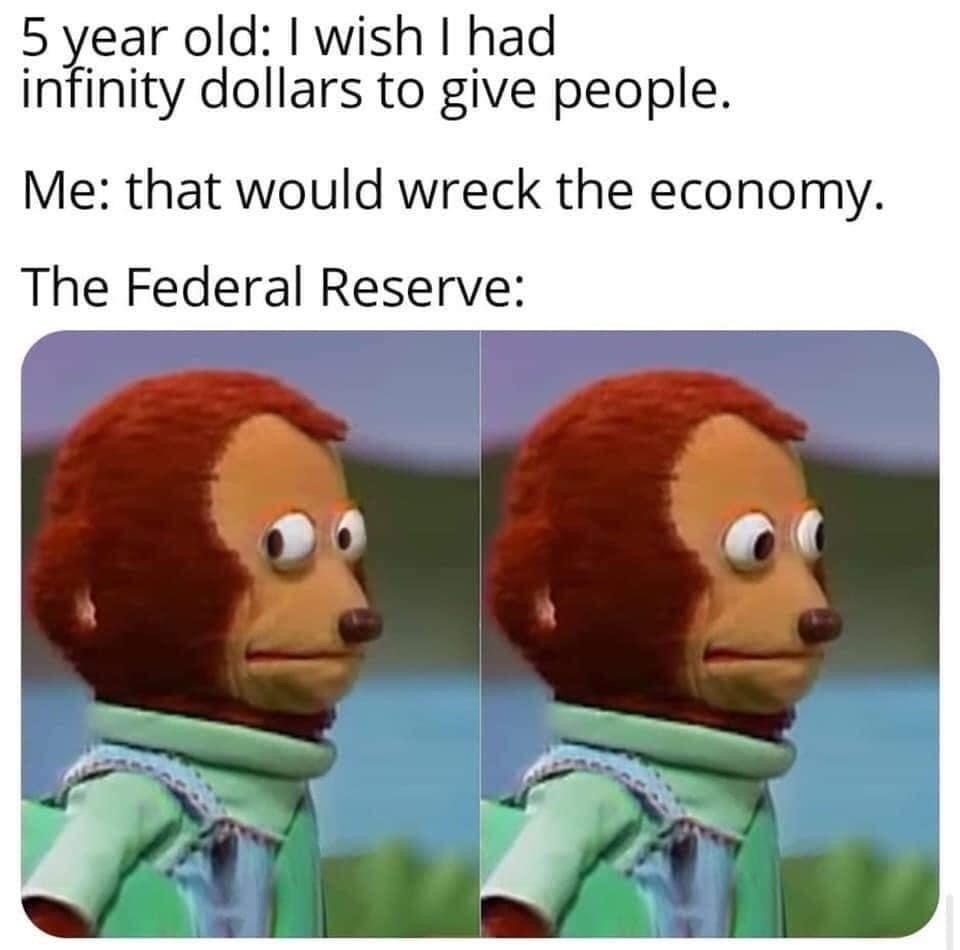

As the Federal Reserve moves from Quantitative Tightening to Quantitative Easing, inflation has been picking up allowing repayment of debt with lesser value over time. The probability of complete debt based monetary system failure seems eminent.

Less demand for US government bonds locally and abroad needed creative solutions.

Enter Stablecoins and the Genius Act

https://www.hivemind.capital/content/the-genius-act-explained

Allowing for financial institutions to create cryptocurrencies pegged to the US Dollar and backed 100% by deposits and/or short term treasuries. This does several things. It frees up liquidity allowing for pools of bank holdings to be monetized and move through the economy instead of being required to be held as commodities.

Stablecoins also create a built in demand for treasuries without the need for a US Central Bank Digital Currency (CBDC) to be created. The US may create a CBDC, but that may mostly be used for purposes of international monetary settlements. https://www.investopedia.com/us-cbdc-6740586

“The best things in life are free

But you can’t give them to the birds and bees.”

So far companies like Tether and PayPal are making Stablecoins a reality. They are also paying around 4% “interest” for deposits in dollars 1-to-1 to USDC https://www.usdc.com or PYUSD. There are many more listed here:

https://coinranking.com/coins/stablecoin

Will this transformation work? Time will tell but signs are promising.

Now if we could just get the US Government to open up and get to work!

Next Time: Kings, No Kings and the King of Kings.

Leave a comment